It’s time to find your next great product. You’ve heard about a type of item that sells pretty well, and you think it’s worth investigating. Now, it is time to dive deeper into gathering competitive intelligence before you decide to launch your new product. The simplest way to research a market is to search for that product on Amazon and see what comes up.

So you run the search, and….now what? How do you interpret the results so that you know if this will really be a good item or a new trend?

There are a few key indicators of how much room there is for another seller in the space. They are:

How many sellers are in the market

The performance of sellers in the market

The dominance of the top seller(s)

Researching in Amazon

How many sellers are in the market

When you search for an item, how many results come up? Depending on whether you count sponsored listings, you’ll see 40-50 results per page. So multiply the total number of page results by 40, and that will tell you roughly how many listings exist for this type of item.

Seller performance in the market

Now you’ve got a number but…how’s everyone doing? There needs to be enough sales for the market to support another seller. At a glance, you can tell how well a product has sold based on the number of reviews.

Typically, products will get reviewed only 1-2% of the time, though effective sellers can get up to 5%. This means you can multiply reviews by 50 to get a guess at a product’s historical sales. Open up one or two listings, scroll to Product Details, and you can see when that listing was created. If the highest reviewed item has been around a year and has 50 reviews, then you can predict that the absolute best you can do, at least initially, would be to sell 2500 products in a year (50 reviews X 50 purchases per review / 1 year of sales).

Growing a market is difficult to do in Amazon, so you have to start with the expectation that your success will come at the expense of others in the market. These rough estimates will need to prove that there is room for you to jump in.

Top Seller Dominance

What is your goal with this product? To take just a piece of the market, or to become the biggest seller in town? Either way, you need to know how strong of a grip the top sellers have. The top seller is most likely to be the one with the most reviews, but there could be any number of clues to look out for.

Is one product listed as “Amazon’s Choice” or “Best Seller”? Which one has the best rating? Which one was the very first search result? You can also look through product listings and see which one has the best sales rank. If the same product is the answer to all of the above, that means you’ve got a very dominant seller.

Sometimes different products will meet those criteria. This will help you learn where to focus. If there’s one listing with a thousand reviews, and dozens of listings with fewer than ten each, you can ignore those listings for this next part; customers certainly are.

When there’s one clear top selling product you need to find out where it’s vulnerable. What’s the product’s rating? What are concerns in the reviews? Is the listing well managed? A weakness in any of these areas could signal that a seller doesn’t know what they’re doing, and lucked into being the best. Perhaps there’s a simple fix to customer complaints. Maybe a similar product could sell better if the listing explained the product’s value more clearly. This is your best chance to jump into the market, by addressing one of those issues.

If a range of products have found success, you will have to do more work to find out customer concerns with the products, but it should be easier for you to gain market share, since the target market has yet to settle on a clear favorite.

If you’ve determined there is room for you to sell this product, it’s simpler if you only have to pay attention to one dominant competitor, but might be trickier than if sales were more spread out. Think about it this way: would you rather have tried to sell your mp3 player before or after the iPod came out?

Competitive Intelligence Research Tools

Research is never a perfect process, and tools can often make this simpler for you.

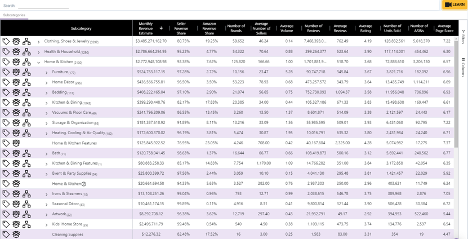

SmartScout offers several solutions that can make finding your next product a little easier. When creating your own product, the most useful feature is likely to be the Subcategories tool: we’ve catalogued each of Amazon’s 40,000 subcategories, with a dozen convenient filters for your research needs.

If you have no idea where to start and just want to explore, filter for things like monthly revenue, Amazon revenue share, average number of sellers, and average rating. This will show you the specific subcategories that meet criteria you think you can work with.

If you have an idea for a product, try searching at the top to see which subcategories have the products you’re after. From there, you can decide if you want a small piece of a larger market, or a large piece of a smaller one.

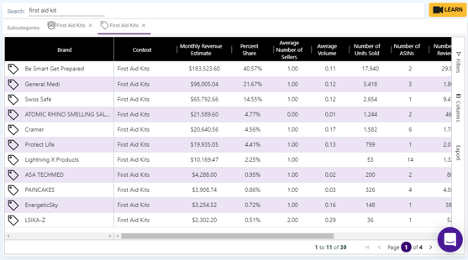

You can open tabs within the tool to compare different subcategories, analyze the different brands and products available within them, and quickly see the data to make an informed decision. For instance, rather than trying to guess how many items are in the market and who the top seller is, we can simply provide the information for you. By clicking the box symbol, you’ll get a list of all products in the subcategory organized by monthly revenue.

By clicking on the price tag icon, you’ll see a breakdown of the brands in the category, including what percent of the market they control.

For those without a product idea, there are numerous ways in SmartScout to find ideas for new products, and the competitive intelligence data to research them. You can research top brands, see what other sellers are up to, and look at the “Frequently bought together” items that Amazon recommends on specific product pages.

At the beginning of this blog, we recommended some of the core questions you need to be asking, but there are a hundred different ways to find the answers. SmartScout is one tool that can help you easily find answers to those core questions and more.