(This article was first published on November 6, 2020. We recently updated it to include the latest results from Black Friday and Cyber Monday 2020.)

For this year’s holiday shopping season, there’s a sense of both opportunity and uncertainty in how the next weeks will unfold.

On one hand, sellers expect to receive more online shoppers than ever before. And, they’re looking to find creative ways to stand out among their competition. But, they also face uncertainty when it comes to inventory forecasting, supply chain challenges, and the ability to guarantee delivery dates during the current circumstances.

Here’s what we know so far to expect from this year’s shopping season.

Total Spend During the 2020 Holiday Season

Despite the pandemic, experts still forecast an increase in total retail sales, with a steep rise in online shopping as consumers avoid in-store shopping.

- Total US retail sales will rise 0.9% to $1.013 trillion.

- US retail eCommerce sales will jump 35.8% to $190.47 billion, accounting for 18.8% of total retail sales.

- US brick-and-mortar retail will decline 4.7% to $822.79 billion.

Unfortunately, many consumers are dealing with serious hardships this year with the pandemic, high unemployment, and ongoing economic uncertainty. Recognizing this, experts only see a modest increase in overall sales.

What Happened: While total spend is up from last year, it ultimately will end up a bit less than previously predicted. As of December 3, Adobe’s research predicts total US retail sales to reach $184 billion, down from previous estimates of $189 (and eMarketer’s above). [Retail Dive]

Holiday Shopping Has Already Started

This year’s shoppers started their holiday spending early.

For many, they’re shopping earlier to take advantage of sales or promotions. And unlike years past, Amazon Prime Day happened in October, which kicked off many deals from Amazon and others that rivaled Black Friday and Cyber Monday sales.

The top three reasons for consumers to shop earlier than usual are:

- Sale or promotion — 53%

- Avoiding crowds — 37%

- Avoiding the stress of last-minute shopping -— 31%

- Worried that items I wanted were going to sell out — 26%

What Happened: By early November, 59% of consumers had started shopping for the holidays and completed on average 26% of their total shopping. By late November, 85% had started shopping and completed on average 51% of their total shopping. [NRF]

Surge of eCommerce

As indicated above, most experts expected an unprecedented amount of online shopping, even as double digit growth has been normal over the past few years.

46% of shoppers will buy most of their holiday purchases online, and 77% intend to buy more than half of total purchases online. [Digital Commerce 360]

The Majority of Shoppers Plan to Buy from Marketplaces

When shopping online, most consumers (61%) also intend to turn to marketplaces like Amazon to make their purchases, which significantly outpaces the (21%) that will purchase directly from a brand itself. [Digital Commerce 360]

With this large difference, it’s important to know why many shoppers prefer marketplaces over buying direct from retailers. Their top reasons are:

- Better Prices — 67%

- Free and discounted shipping — 63%

- Speed of delivery — 45%

- In-stock products — 41%

- Finding very specific items — 40%

If you’re selling on marketplaces like Amazon, make sure you avoid these common seller mistakes this year that could get your account suspended.

A Note on DTC: Since the start of the pandemic, 52% of DTC brands experienced surges in demand. This trend is likely to remain well into the holiday shopping season as consumers and brands alike move toward the direct-to-consumer model.

What Happened: Amazon continued to roll through the holidays setting their own records. Amazon third-party marketplace sellers surpassed $4.8 billion in worldwide sales from Black Friday through Cyber Monday, a more than 60% year-over-year increase from the same holiday weekend in 2019, according to Amazon. [Digital Commerce 360]

Top Shopping Days

This year experts still predict Cyber Monday and Black Friday to be the biggest sales days of the year.

Cyber Monday will be the biggest online spending day in US history with sales of $12.89 billion, up 38.3% from last year.

Black Friday will follow with anticipated sales of $10.20 billion, an increase by 39.4%.

The biggest increase in sales from last year will be on Thanksgiving Day, predicted to increase 49.5% to $6.18 billion.

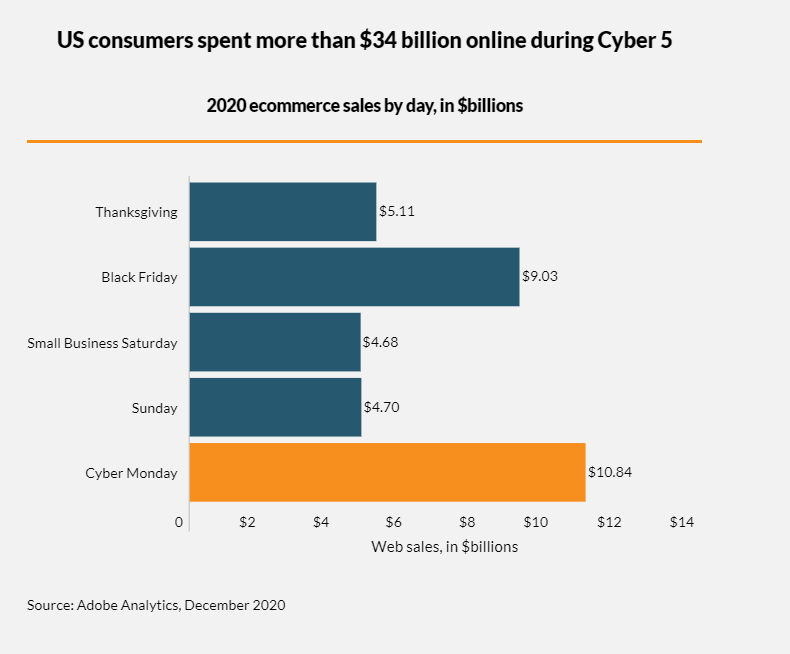

What Happened: U.S. shoppers spent a record $34.36 billion on retail websites over the 5-day period from Thanksgiving to Cyber Monday, up from $28.49 billion from the same period last year. However, the total spend online was less than previously forecasted. Here’s the breakdown:

Small Business Saturday

During the holidays, Small Business Saturday tends to be an in-store event rather than online.

Even as consumers indicate that they’re not as likely to shop in-person this year, experts still see overall sales increasing year over year for Small Business Saturday to $4.76 billion. While this is a 35.6% increase, it does not rival Black Friday as closely as 2019. [eMarketer]

During the pandemic, there’s been a call to support small businesses as they face their own financial challenges. Sellers that revamped their online storefronts and upped their customer service over the past few months have put themselves in good position to perform well this holiday season.

What Happened: Consumers answered the call to shop small this holiday season! Out of the big 5 shopping days from Thanksgiving to Cyber Monday, Small Business Saturday increased its share of weekend online sales the greatest. It had 68.2 million online shoppers, up from 17% in 2019. And, digital revenue grew 30.2% year over year. [Digital Commerce 360]

Delivery Remains Biggest Uncertainty

One challenge of unprecedented online shopping is its impact on delivery. There’s already volume concerns, and it will only get worse.

At USPS, shipping and package revenue in Q3 increased by $2.9 billion, on a volume increase of 708 million pieces, or 49.9%, compared to the same quarter last year. [USPS]

And, the stakes are high for retailers. Despite these backend challenges, consumers still demand and expect on-time delivery. And when you don’t deliver, they may not buy from you ever again.

Foreseeing issues with delivery, most retailers are encouraging early shopping to help spread out deliveries over the entire shopping season.

Luckily, 42% of shoppers will shop earlier knowing that delivery times could be delayed this holiday season. [Digital Commerce 360]

Nonetheless, sellers do know that they will have to pay more with carriers this season.

Expected holiday shipping surcharges:

- FedEx and UPS: Between 5 cents and $5 per parcel

- USPS: Between $1 and $5 per package

These surcharges will cut into margins as sellers face intense pressure to offer free and fast shipping to win over more customers.

Here’s what consumers say are the most important factors when choosing an online retailer this holiday:

- Free shipping — 71%

- Competitive prices — 63%

- Product in stock and ready to ship — 53%

- Speed of delivery — 48%

With surcharges to think about, retailers have to be thoughtful when setting their shipping thresholds and prices. Otherwise, they risk draining their profits. Read more on why shipping is so expensive, and what you can do to lower your overall costs.

What Happened: As expected, carriers raised prices and are holding merchants to their volume agreements. As of December 2, it was reported that UPS imposed shipping restrictions on some large retailers like Gap, Nike, and Newegg. These temporary limits are an indication that carriers are doing everything they can to keep up. [Wall Street Journal]

Alternative to Delivery: Curbside Pickup

Fortunately, some holiday shoppers will opt for curbside pickup during the shopping season, which helps alleviate some pressure from the significant increase in shipping online orders.

29% of consumers intend to place an order online and pick up in store this season, which was the second highest category after shopping on marketplaces (61%). [Digital Commerce 360]

This is good news for small neighborhood shops and big box retailers alike who already spent time this year promoting and revamping their curbside pickup to offer hassle-free and safe experiences during the pandemic. Now, they’ll see if their processes still hold up under holiday traffic.

What Happened: Curbside pickup grew 30% on Cyber Monday from 2019. [Retail Dive]

Holiday Returns

A reality of online shopping, especially during the holidays, is the volume of returns that come during and after. And returns are another area where shoppers are more likely to ship versus heading in-store due to the pandemic.

67% of shoppers prefer to ship their holiday returns this year rather than return in stores because of the perceived risk of COVID-19 exposure. [Inmar Intelligence Survey]

Many retailers will likely see a higher volume of returns this year, and will need to adjust their processes and capacity to handle them. For more on this topic, here are some tips for how to improve your online return process and information on how to reduce chargebacks.

Last-Minute Prep for Holiday Marketing

While overall sales look positive, especially for an unprecedented amount of online shopping, there’s still a lot of uncertainty of how sellers will hold up under these tough circumstances.

To keep up on any trends or tips for online selling, subscribe to the Payability newsletter to get insights sent straight to your inbox.

Sources and Citation Info:

To be clear, none of the statistics above are based on research by Payability. This post is a compilation of statistics from various web sources that are cited throughout the article. We hope to give you one, convenient place to find data about 2020 holiday shopping trends.

For any formal or academic purposes, please cite the original source of the data.