The first major challenge to becoming a private label seller on Amazon is choosing a product. If you know how to do everything else, such as SEO, PPC, product images, email automation, etc. it won’t matter if you don’t have a product that can succeed. Of course, there is never a guarantee that your product will be a successful one. However, there are ways in which you can maximize the probability of success.

Choosing a product niche is a step that comes before choosing the product itself. You can say that it is one in the same, since a niche is a certain specific subset of a product. Discovering a niche is one thing, fully tailoring a product that fits into it, or preferably, disrupts it, is another matter. The first thing you need to do is identify your corner of the market. However, there are certain aspects of a product niche that you should pay attention to before committing to a product launch.

1. The Competition

You may face a significant barrier of entry. Granted, with a creative enough product idea and superior quality you can potentially go against the odds and come out on top. However, going into a highly competitive niche is something you should avoid if you can, especially if you are just starting to sell on Amazon. There are a few things you can look into to assess how competitive a niche is. One of the first is the average number of reviews on page for the main keyword, or a few keywords, that describe the type of product you want to sell.

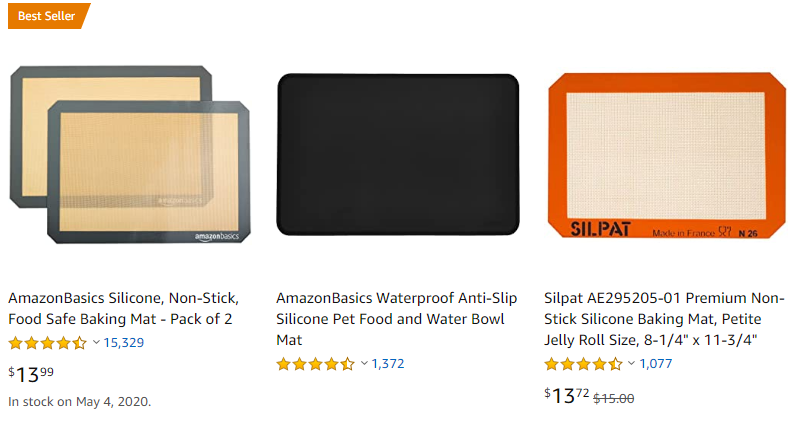

The number of reviews is highly relevant when it comes to shopping preferences on Amazon. The higher the number, the more legitimate a product seems. If we take a look at page one of the search results for “silicone baking mat”, we will see that the top results have a 4-digit number of reviews.

These are extraordinarily high review numbers, which makes it very difficult to compete in this niche. However, the first few results are not necessarily what gives you the full picture, this is why it’s important that we look at average reviews from page one.

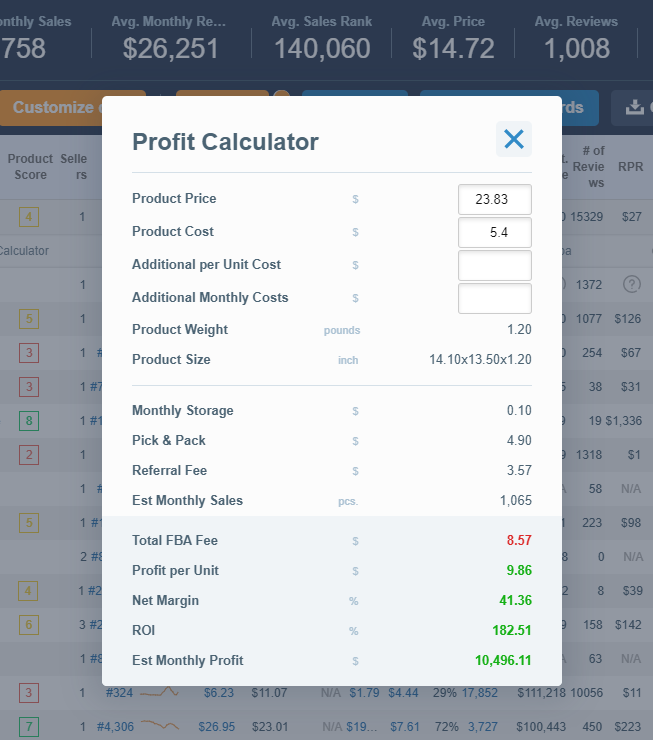

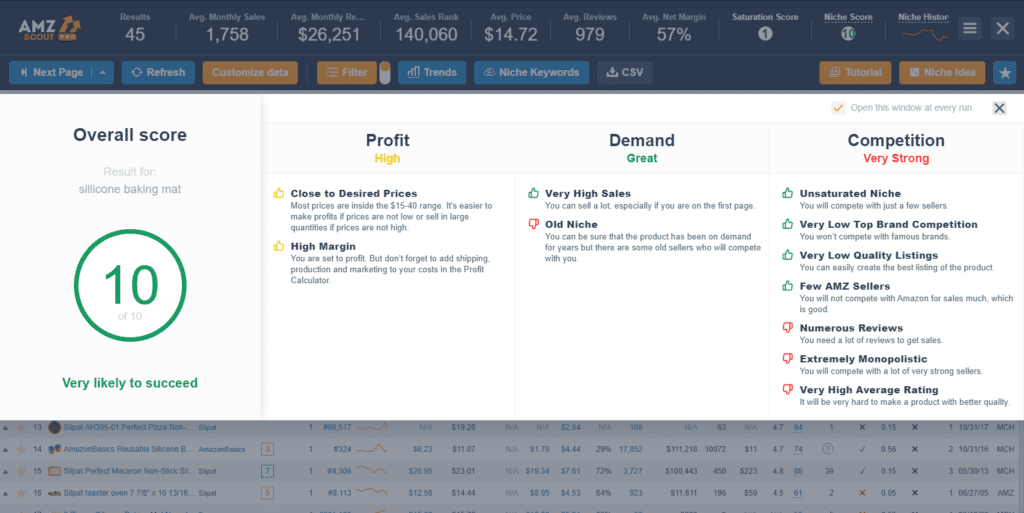

You can of course add up the review count yourself and divide it by the number of results, or you can use the AMZScout Pro Extension and get the results in less then a second:

Based on the results in total, we can see that this is pretty much as competitive as a niche can get. However, it is crucial to look at all the data. Not just make a decision based solely on a handful of results. Ideally, you wouldn’t want to try to compete in a niche where the average reviews on the first page are higher than 200 to 300.

2. The Demand

Once you have determined how competitive a niche is, you need to figure out what exactly you are going to be competing for. If there is not enough demand, there is not really much of a need to compete there in the first place. Demand can be easily calculated with the right tools. The main indicator is pretty straightforward – sales. If people are spending money on a product, that means it’s in demand. The higher the sales the higher the demand.

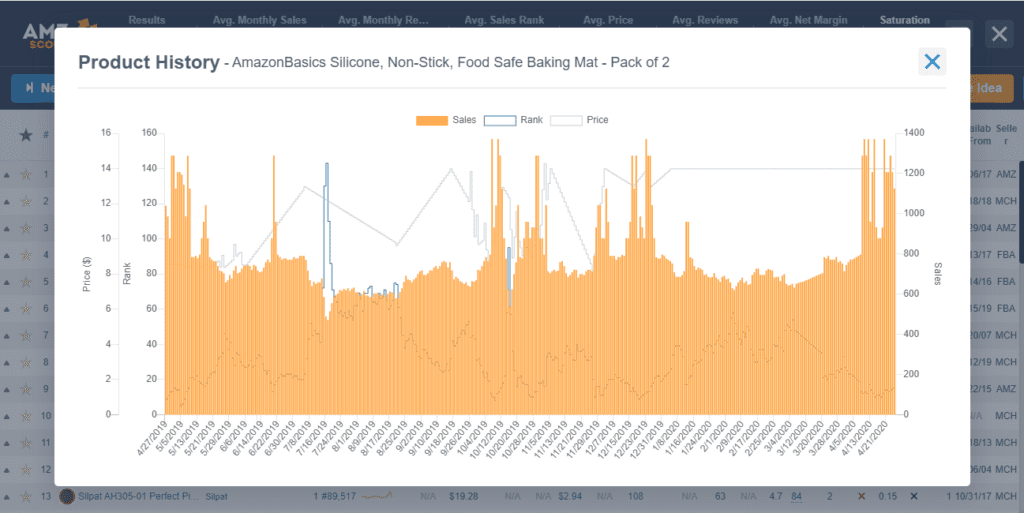

Keep in mind that sales are something that you cannot fully calculate on your own, there is a very imprecise rule of thumb that states that “1 review = 50 monthly sales” which is a shot in the dark to say the least. As you can see on the previous image, the AMZScout tools show you the monthly sales for each of the results and as you can tell the sales don’t exactly correspond to the number of reviews in any measurable way. These numbers are only available if you use software. Also, another very important aspect to the sales volume is consistency. That is why sales history is so important.

Knowing the price history is also extremely insightful. This can indicate what sort of fluctuations you can expect throughout the year. This way you can determine the seasonality of a product as well as if it’s stable or on an upward or downward trend.

If the sales history shows the sales going up, you’ve found an emerging niche. If it’s the opposite, you’ve found one in decline. This is the type of information that can drastically change your decision that you would base purely on the sales volume of the last month.

3. The Customization Potential

After you determine the competition and the demand, the next step is to see if you can actually come up with a product that will do well with a niche audience. In some rare cases, you can make products that are pretty much the same as the ones that are there and simply secure your position through superior SEO optimization and PPC.

However, it is best to find a way to differentiate yourself and stand out amongst the other listings that might show up in the search results. That way you can offer something more or better than the competitors. This is why it’s best that you find a niche within which there is potential for a diverse offer.

Think in terms of, color, design, the number of units per package, features, or materials. Are there aspects of the product in that niche that can be optimized? If you find a niche that gives you a lot of creative room, make sure you find a supplier that can make those customizations if you pursue the product idea further.

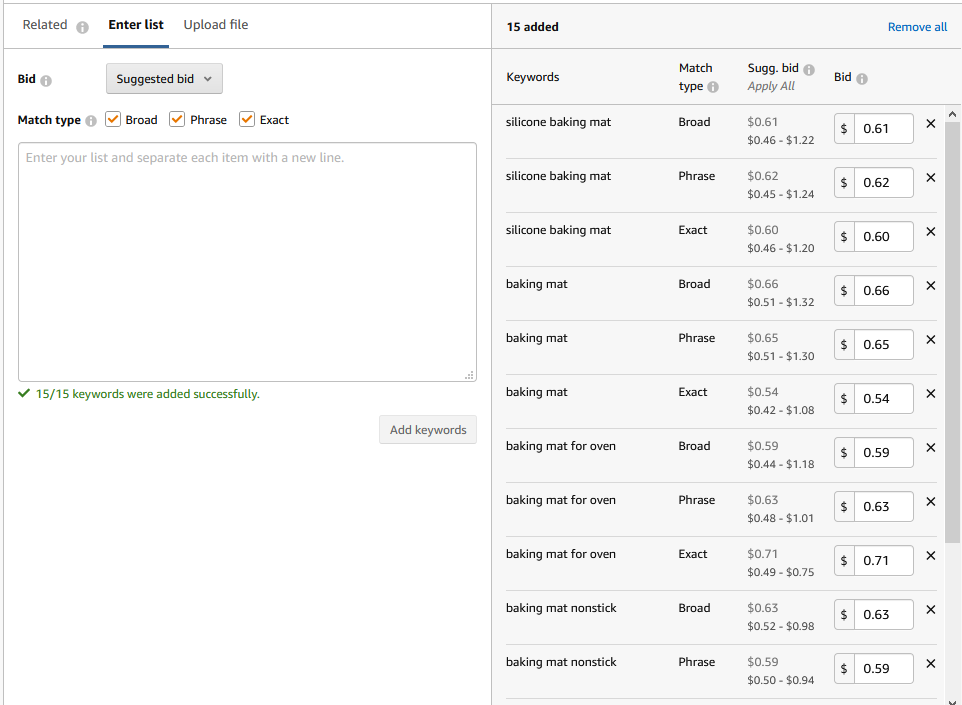

4. The Margins

If the rest of the criteria on this list has been met, now it’s time to do the math and see if selling this type of product makes sense financially. There are three basic per product costs that go into your product margins:

- The manufacturing cost

- The shipping cost

- FBA fees

You are going to need this information in order to properly calculate your margins. So you will need to get some numbers from your future or potential suppliers such as estimates of the manufacturing cost and the shipping cost by air and by sea. You might need to do a few calculations based on the per item price for larger quantities as well.

You should aim for at least a 30% if not a 50% margin. This might not be easy to find. You may be able to eventually reach that margin with a larger order quantity if the product proves to be viable. Keep in mind that the whole profit margin is calculated by more than just these fixed factors. There are also marketing costs to account for which brings us to our final point.

5. The Cost of Acquisition

This is the most difficult aspect of product research to predict or calculate precisely. So you should try to get a basic idea. The cost of acquisition is how much you need to spend on marketing per sale to actually make a sale take place. There are many ways of advertising your product. However, Amazon PPC is likely the best starting point.

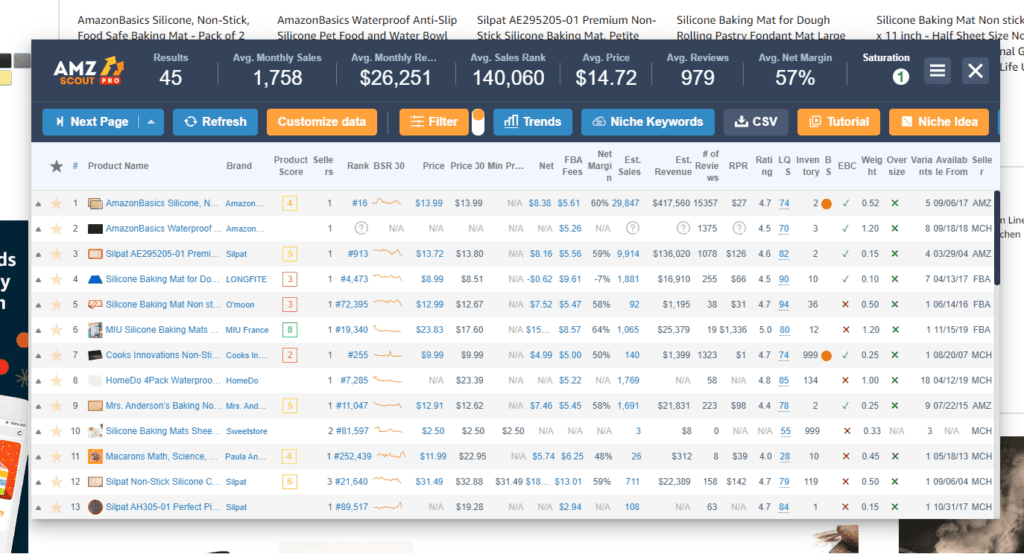

You should try to get an idea of how aggressive your future competitors are in terms of their PPC bids. The easiest way to see this is to go to a campaign creator and put in some of the main keywords for the product type in question. Then see how high the suggested bids are across the three keyword targeting match types. This is how it would look like for the top five keywords for silicone baking mats:

You don’t have to actually create a campaign, just do enough to see the numbers. Based on what you see, you can tell how far your competitors are willing to go in order to advertise on their most relevant keywords. Look at the relationship between the product cost and the individual bids before making a decision. After all, if it costs more to market a product than it does to produce it, it may not be worth it.

It is impossible to predict your conversion rate or ACOS. But, getting the general idea before committing to a product can provide you with insights into how you should approach advertising your new product and what you can expect to spend.

Selecting a niche on Amazon to sell in is a complex decision. There are many factors at play, each one with its own risks and opportunities associated with it. The best you can do is get the most information you possibly can and make an educated decision.