Capital as a Service, Built for the Volusion Platform

Volusion Capital was built to provide Volusion Founders with a fast and flexible capital solution to help grow their online store. With the launch of Volusion Capital, Volusion merchants are now able to quickly and easily apply and receive funding without the hassles and requirements of traditional banks.

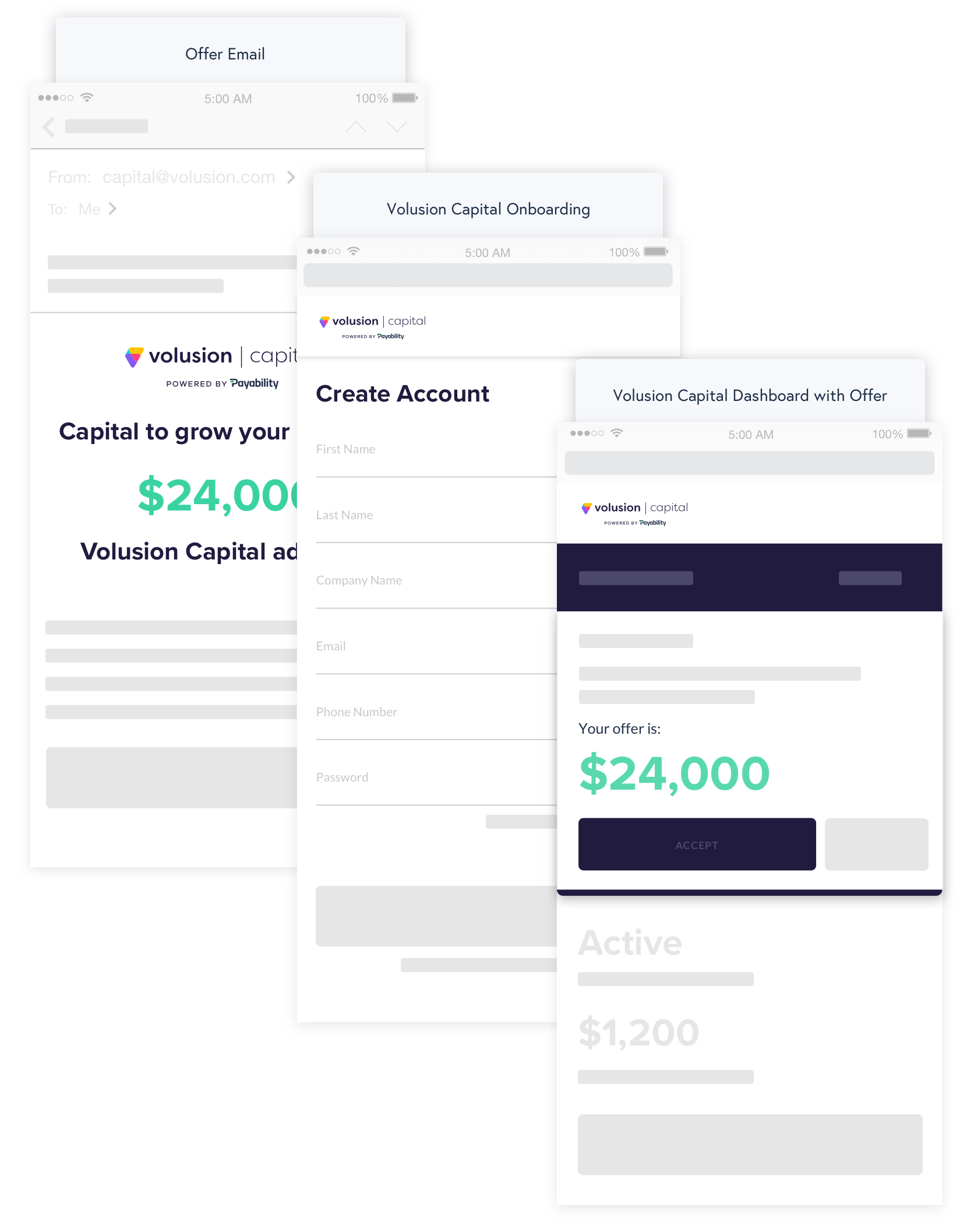

The Volusion Capital Experience

Primary Components of an Embedded Fintech Solution

Why Offer an Embedded Capital Solution?

“Traditional financing doesn’t always recognize the viability of ecommerce businesses. Volusion Capital will change that. Having access to more capital means more inventory, more opportunities, and more sales for our customers. We are excited to offer a solution that provides our ecommerce sellers with a quick approval financing option that will help with their growth.”

– Bardia Dejban

CEO of Volusion

Volusion at the Center of Business Activity:

As an all-in-one eCommerce store builder, Volusion is at the center of their customer’s business activity. From the Volusion platform, business owners can manage orders, inventory levels, web design, marketing, and payment processing. Now, with Volusion Capital, they can apply for and receive funding.

Access to Capital Is a Challenge Worth Solving:

Capital is the fuel that powers e-commerce seller growth, however, traditional financing doesn’t always recognize the viability of e-commerce businesses and fails to meet the demand for capital. More capital means more inventory, more opportunities and more sales. Not only does additional capital help businesses grow, but it presents a substantial revenue opportunity to the platform, as well.

Building a Competitive Offering that Founders Can Trust:

Volusion Capital knows that the Founders on the platform already have a few lending options, however, they wanted to offer their Founders something better. The Volusion Capital offering is a native offering, that Volusion Founders can trust and use with ease.

Creating a Solution Unique to Volusion:

Volusion Capital is bespoke. Volusion Capital is unique. Volusion Capital is made specifically for Volusion Founders. By analyzing Volusion store data and presenting offers to Founders through the Volusion platform, Founders who participate in the Volusion Capital program know that this solution was built with their interests in mind.

“This capital supplemented what we needed to get back up and running in full, which we are now. I’ve been impressed with howwell it’s worked and how upfront all the information was. I’ve not found any hidden fees or issues so I’ve been very happy.”

Seattle Orchid, LLC

Capital as a Service for Your Business

For Platforms

Platforms like Volusion provide SMBs with a variety of tools to grow their business. By adding a capital solution, platforms are able to maintain a crucially important role in the growth and success of their customers’ business.

For Marketplaces

The success of a marketplace relies on the quality and quantity of suppliers and buyers. Providing much-needed liquidity to the supply side of a marketplace through an embedded financing solution, Payability is able to help scale the goods and services being provided and increase marketplace GMV.

For Inventory Suppliers

Often the biggest barrier to selling more inventory to your customers is the availability of capital. Merchants need a fast and simple financing solution to make substantial and frequent investments in their inventory. Payability’s embedded financing solution can help provide the liquidity your customers need to make bigger purchases and keep coming back to buy more.