Having a dedicated bank account for your small business can help you manage your finances, while keeping them separate from your personal ones.

In the past, you might have gone to a nearby traditional bank to set up your account. But today, more small business owners are turning to full-service online banking platforms instead.

Traditional brick-and-mortar banks usually gear their bundled offerings towards large organizations, where they’ll see greater profits. For small business owners, banks that charge fees, impose minimum deposit requirements, limit your number of transactions, and have lengthy approval processes are frustrating to deal with and costly to your business.

Recognizing the different needs of small business, online banking platforms offer easier and more affordable services. Keep reading to learn more about what an online bank is and their pros and cons for small businesses.

What’s an Online Bank?

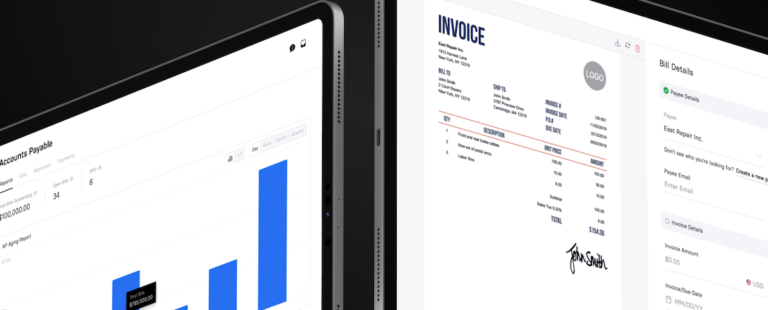

To be clear, online banking providers are not the same as traditional banks. They’re independent technology platforms that are built on a network of commercial banks. By partnering with banks, they can offer the necessary financial capabilities and deposit security to individuals and small businesses. The online banking platform itself then offers financial services like checking accounts, corporate cards, expense management, and bill pay — all in one full-service digital platform you can reach anytime online.

As an alternative to brick-and-mortar financial institutions, online banks intentionally tailor their services towards consumers and small businesses that are usually underserved.

Top Benefits of Online Banking for eCommerce Sellers

Here’s the top benefits of using a full-service digital bank for your eCommerce business.

1. Offer Debit / Credit Cards

Alongside checking accounts, online banking services can also offer corporate debit / credit cards connected to your account. Many of these cards can include cash-back rewards, high credit limits, and more.

2. Integrations with Other Business Tools

Online banking platforms provide seamless integration into your other business tools like:

- Accounting platforms (Xero, Quickbooks, Wave)

- Internal Communication tools (Slack)

- Payment processors (Stripe, Square, PayPal)

- eCommerce platforms (Shopify)

- International banking (Transferwire)

This allows your online bank to become the central platform to manage your cash flow, expenses, and payments. Not to mention online banks can often give you additional insight and analytics into your business that you likely won’t get from your community bank.

3. 24/7 Mobile Banking

You can access an online bank 24/7 (as long as you have an internet connection). Since most of your eCommerce business will be done online, merchants usually have little need to access a physical bank branch. You can perform most of your banking needs on-the-go like paying bills, transferring money, and depositing checks, which you can do through the online bank’s intuitive mobile app or by logging in online.

4. Easy and Fast Approval Process

A traditional bank’s lengthy approval process for opening an account can be a hassle. It requires going into a physical branch, lots of paperwork, and slow processing times. With online banks, you can set up an account in minutes through a simple online application.

5. No Fees / Low Costs

Since online banks don’t have physical locations, they don’t have to worry about overhead costs like maintaining buildings, paying rent, utilities, etc . These costs then aren’t passed along to you as the customer, which means online banks charge little to no fees for their services like:

- No account minimum balance requirements

- No fees for non-sufficient funds

- No ingoing or outgoing ACH transaction fees

- No domestic wire fees

- No bill pay fees

- No monthly service fees

- No overdraft fees

- Free checkbooks

As a growing eCommerce merchant, every dollar counts. Not worrying about being nickel-and-dimed by your bank can be a big win for your business.

6. High Yield Rates

If you look across the industry, online banks are paying the best APY (annual percentage yield) interest rates. APY is really just a fancy term for cash back. Without overhead costs, online banks can offer high yield rates on their accounts, even as much as 1%. For reference, the average checking account has a 0.04% APY and the nation’s biggest banks can pay yields closer to 0.01%.

This means that an online bank could pay you $100 in interest for $10,000 in savings versus only $1 from an account with 0.01% yield. That’s money in your pocket for deposits you need to have anyway. While traditional banks tend to charge you monthly fees just for having a business bank account, online banks give you cash back in the form of APY.

7. Schedule Online Bill Payments

With an online banking platform, you can set up and schedule one-time and recurring payments. For a constantly moving eCommerce business, this makes paying general expenses easy and fast.

8. Online Support

A common misconception of online banking is that they won’t provide the same level of customer service or support as a physical branch. However, the opposite can be true.

Most online banks have 24/7 support that you can reach via phone, chat, or email. And, providers like Rho Business Banking offer 1-to-1 advisors, a dedicated business banker for your account that you can call anytime.

Cons of Online Banking for eCommerce Sellers

While online banking mostly includes advantages for small businesses, there are some drawbacks to be aware of.

1. Tech Issues

While 24/7 online banking is great, it can become a problem if you have trouble accessing the internet or their platform goes down for some reason. In the rare occurrence that happens, you could have difficulty reaching your bank when you need to.

2. Security

Like any online service, there’s also the risk of fraud if someone gains unauthorized access to your account through a hacked password or login.

As online banking grows, you should also be diligent in checking whether your provider has a financial backing institution for insurance. This ensures that your money is protected in the event of a bank failure. Industry standard is $250,000 per depositor, per insured bank.

You don’t have to sign up for this insurance yourself. If the online bank provides it, you will be automatically covered when you open an account.

To check if a bank provides deposit insurance, look for coverage like FDIC. Here’s an example of Rho Business Banking and how it’s mentioned on their pricing page.

3. Features for Complex Transactions

Many online banking platforms keep their services simple and cost-effective. So, while they offer no fees and unlimited transactions, you can sometimes be limited in your ability to do complex transactions like sending payments in multiple currencies.

For most eCommerce businesses though, an online bank is going to cover your must-have needs.

4. Inconvenience for Direct Deposits

Without physical locations or ATMs, online banks can be difficult to deposit or withdraw cash with. (Depositing checks can be done through a mobile app). Some online banks won’t accept cash deposits at all and others will have workarounds like:

- Cash deposits supported through a chosen network of ATMs

- Mailing a check, transferring money from another bank, and using the bank’s e-check deposit service

However as an online business, you probably won’t deal with cash often, if at all.

Get Started with Online Banking

For most eCommerce merchants, using an online bank can be a great alternative to a traditional one. You’ll save money and time managing your finances so you can focus on growing your online business. To get started, schedule a demo with a Rho Business banker.