Sales feel slow after October Big Deal Days. See data on the lull, charts on seasonality, and a two week plan for conversion, ads, inventory, and reseller tactics before BFCM.

Between October Big Deal Days and Peak: What To Do During the Lull

October’s Prime Big Deal Days deliver a clear spike, then most categories cool for roughly 10 to 21 days before Black Friday and Cyber Monday. That cooldown is normal. Adobe estimates U.S. shoppers spent about 9.0 to 9.1 billion dollars online during the October event this year, with discounts peaking around 17 to 18 percent off list prices. Cyber Week will still dwarf that window, with Adobe forecasting 43.7 billion dollars over the five days from Thanksgiving through Cyber Monday and 253.4 billion dollars in total U.S. online spend for Nov 1 to Dec 31. Retail TouchPoints

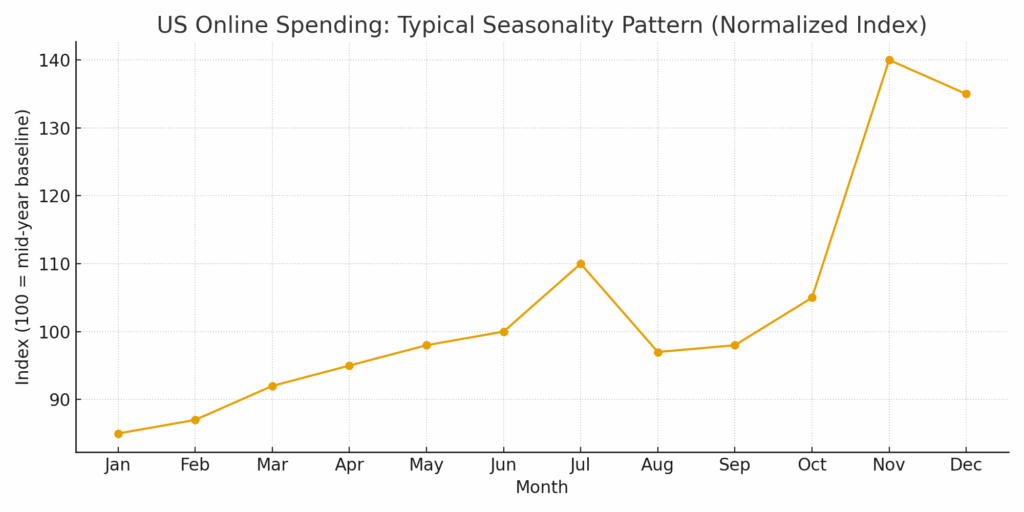

Visuals to ground the pattern

The shapes mirror what industry trackers report every year: a fall spike around the October event, a short cooldown, then a steady ramp into late November and December where spending concentrates. Adobe and NRF both show that while many shoppers start early, most still finish in December, which is why performance can feel softer in late October and early November before the rush. National Retail Federation

Why the lull happens

- Deal hunters step out: Two-thirds of global shoppers say they hold out for Cyber Week because they expect the best discounts then, so conversion softens after the October event. Salesforce also expects average discounts to peak around 28 to 30 percent during Cyber Week, higher than October. Salesforce

- Auctions reset: Ad costs and placements rebalance after heavy event spend, which can shift traffic mix and reduce efficiency temporarily. Adobe’s holiday outlook still calls for a record season, but at 5.3 percent growth this year versus 8.7 percent growth last year, which reinforces a measured ramp rather than a straight line. Adobe Newsroom

- Calendar behavior: Early shopping is common, yet the majority finish in December, so demand clusters late and leaves a quiet gap after October deals. National Retail Federation

Two-week operating plan for the lull

Week 1: Stabilize conversion

- Lead with images: refresh hero and top gallery frames for fall use cases.

- Clarify the offer: tighten title and bullets, add a concise “who it is for” block in A+.

- Visible value, controlled cost: run a modest, time-boxed coupon if margin allows. October discounts averaged about 17 to 18 percent, which is lower than Cyber Week, so you do not need to chase steep cuts to stay competitive right now. Retail TouchPoints

- Fix silent blockers: check Buy Box percent, delivery promises, suppressed variants, and mobile crops.

- Returns recon: scan top return reasons and update copy or images to preempt repeats.

Week 2: Rebuild efficient traffic

- Aim by intent: defend branded queries first. Spin out exact-match winners from recent search terms.

- Cut waste: add negatives, cap broad and phrase until conversion normalizes.

- Warm beats cold: use Sponsored Display to re-engage PDP viewers and cart abandoners where eligible.

- One change at a time: test a placement multiplier, then product page placements, then creative. Measure each move before stacking more.

Marketplace Sellers & Resellers: a focused playbook

Sourcing and rotation

- Replenish proven ASINs first using 30 and 90 day velocity and margin.

- Validate with history, not hype.

- Bundle a slow mover with a hero SKU to move aging units without deep discounting.

- Confirm prep-center and carrier lead times so inbound lands before holiday cutoffs.

Pricing and Buy Box

- Tighten repricer floors during the lull to reduce price whiplash.

- Shift traffic off listings where you cannot hold Buy Box or stock.

- Use MFN as a temporary bridge if FBA is light and delivery speed remains competitive.

Ops hygiene

- Check stranded and suppressed inventory daily.

- Stagger smaller inbound shipments to reduce FC delay risk.

- Keep detail pages aligned with what ships.

Daily checks for the next 14 days

- Sessions, unit session percent, and Buy Box percent.

- In-stock rate, inbound status, stranded inventory.

- Search term efficiency: top converting queries, wasted spend, and exact-match performance.

- TACOS and contribution margin after ads.

- Return rate and dominant reasons.

Weekly cadence that works

- Monday: review KPIs, choose two small experiments.

- Wednesday: pull search terms, add exacts and negatives, right-size bids.

- Friday: conversion audit and inventory check, confirm next week’s creative or bundle tests.

What the numbers say about October versus BFCM

- October Big Deal Days: roughly 9.0 to 9.1 billion dollars in U.S. online spend over two days. Discounts averaged about 17 to 18 percent. Retail TouchPoints

- Cyber Week ahead: forecast 43.7 billion dollars across the five days, with the season total at 253.4 billion dollars online. Cyber Monday alone typically exceeds 13 billion dollars. This is why late October can feel quiet compared to what is coming. Adobe Newsroom

- Shopper timing: 42 to 45 percent of consumers start before November, yet 60 to 62 percent finish in December, so expect a lull after October deals and a strong finish. National Retail Federation

Quiet October weeks build durable Q4 wins. Tune what buyers see first, aim ads at queries that already convert, keep your fastest movers in stock, and pace experiments so you enter peak with momentum.

Need to support your marketplace growth? Find out more about scaling with Payability at bit.ly/sellQ4. Take charge of your cash flow and grow to new heights.