How Your Amazon Account Level Reserve Actually Works

As an Amazon seller, getting access to your money can be a frustrating experience. It’s normal for sellers to wait at least 14 days to get paid. If Amazon decides to hold back your money for even longer, it puts you in a tight spot with cash flow. It’s frustrating not knowing when your hard-earned payouts are going to hit your bank account.

Have you ever wondered why there’s a 14 day delay in the first place? Why do you sometimes have to wait even longer than two weeks for payment?

To help you answer these questions (and more), we put together the definitive guide on understanding how Amazon pays its sellers. We cover Amazon’s payment terms, when and how you’ll actually get paid, how you can initiate early payments, what your cash flow options are, and more.

When you have a better understanding of Amazon payouts and your account level reserve, you can take better control over your income — and your business growth. Let’s get started!

What are Amazon’s Seller Payment Terms?

Amazon’s Seller Payment Cycle

How Do Amazon Payment Transfers Work — and When Will You Get Your Funds?

What is the Request Transfer Button?

Amazon Daily Payouts vs. Next-Day Payouts: What’s the Difference?

What Is an Amazon Account Level Reserve?

Why Did I Get a Reserve On My Account?

Amazon’s Reserve Tiers

How to Avoid An Account Level Reserve

What to Do When You Have An Account Level Reserve

Take Control of Your Cash Flow & Unlock Your Account Level Reserve

What are Amazon’s Seller Payment Terms?

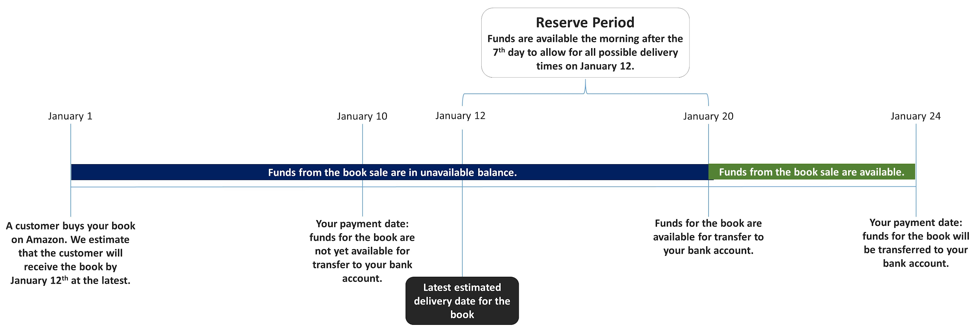

In most situations, Amazon pays you every two weeks. Each payment includes 14 days of your orders (less Amazon’s fees) that were delivered at least 7 days ago.

The actual dates of each payout will depend on when you signed up as a seller. This means that Amazon doesn’t necessarily initiate payments on the 1st and 15th of each month like some marketplaces do.

Amazon pays proceeds out 7 days after the latest estimated delivery date because they value customer satisfaction. Holding your payouts for some time allows your buyers to assess their orders for any issues.

If a customer is dissatisfied and asks for a return within that 7-day window, it will be processed from the funds that Amazon has on hold.

Amazon’s Seller Payment Cycle

Here’s a sample timeline from Amazon about the payout schedule:

It’s common to wait more than 14 days for your payment.

Here are a few reasons why:

- If orders are delivered within 7 days of your payout date, the balance will roll over into the next payment period.

- Actual money transfers can take 3-5 business days to post to your account. So every 14 days when Amazon typically pays you.

- Amazon might hold back all or part of your payment for more than 14 days as an “account level reserve” (more on this below).

How Do Amazon Payment Transfers Work — and When Will You Get Your Funds?

When all is said and done, you might not get your payouts for 17-19 business days after making a sale. Let’s break it down:

Amazon uses only one method of payment: ACH transfers to your bank account. Because these are not Same Day ACH transfers, you can expect to see your funds in your bank account within 5 business days. Whether it’s the next day or the fifth day depends on the bank you use and the type of account you have.

According to Amazon, “Transfers can take 3-5 business days to complete. The current amount displayed is an estimate and may vary from the amount transferred based on new activity in your seller account, including: product sales, fees, refunds, chargebacks, and A-to-z Guarantee Claims.”

This 3-5 business days is in addition to the 14 day payout cycle, hence why you could end up waiting nearly 20 days for payment.

Regardless of how long payment takes to post, you’ll see a deposit labeled in one of two ways (or you might see two individual deposits):

1. “Amazon Payments, Inc.” covers transactions where buyers agree to pay on or before the shipment of goods.

2. “Amazon Services LLC” includes transactions where buyers agree to pay after shipment.

What is the Request Transfer Button?

Eligible Amazon sellers will have a Request Transfer button in their Amazon dashboard.

The Request Transfer button initiates a payment transfer before your regularly scheduled payout date.

However, this doesn’t necessarily mean you’re getting paid early.

Instead, you’re initiating a transfer of the current available payout (i.e. of orders delivered 7-10 days ago that are available on the day you hit the button). The whole amount you see in your account essentially shows you what you WILL have available — in other words, it includes the funds for all orders, not just those marked delivered.

Once you initiate a Request Transfer, the normal payment period closes and a new two-week cycle begins. So, you are effectively pushing out the date of full payment to get a portion of it early.

Let’s consider this example:

- You have a pending balance of $5,000, which is scheduled to be transferred on the 30th.

- It’s the 20th and you need a boost in cash flow, so you hit Request Transfer.

- On the 20th, $1,000 of the balance that has been marked delivered for 7+ days is available for transfer.

- This transfer of $1,000 is expected to show in your bank account in 3-5 business days.

- The remaining $4,000 will be deposited 14 days from the 20th (not on the 30th as originally scheduled).

Here are a few other key considerations about the Request Transfer button:

- You can choose to “Request Transfer” every 24 hours. Each new request will initiate a transfer of the remaining balance that is available that day (again, not the full balance).

- Some fees (like shipping) might be deducted from the amount of your requested transfer.

- Similar to a regular Amazon ACH transfer, a requested transfer may not hit your account for 3-5 additional business days.

Always keep in mind that every time you hit the Request Transfer button it resets your payment date for another 14 days.

Some sellers use the Request Transfer button to increase their payment frequency — i.e. to get daily payouts or weekly payouts. While you may initiate Amazon payments each day that you click the button, it does not necessarily mean that you’ll get daily payouts — or any payout for that matter. This is because Amazon might choose to not release funds on the day you request or to only release a portion of it.

If you’re unsure about whether or not to click the button, you may want to try out Request Transfer during a time when your cash flow is already flush. That way, if Amazon decides to NOT release funds and also resets your 14 day payout cycle, you won’t be too strapped for cash.

Amazon Daily Payouts vs. Next-Day Payouts: What’s the Difference?

You may hear about other Amazon sellers having daily or next-day payouts — or maybe you’re even one of them. But what does this actually mean? Such payouts could happen in a variety of ways. Let’s take a look.

Daily Payouts

Daily payouts from Amazon can be a reality if you have access to the Request Transfer button and click it every day. In this case, you are getting paid every day. But, these Amazon payments are not real-time or next-day. This is because there’s still a 14+ day delay from the date your sales closed and inventory was scanned, shipped and delivered. So, if you have a big sales day, you’ll still need to wait 14+ days to access those funds.

Next-Day Payouts

Next-day payouts can only happen in one of two ways:

Grandfathered Accounts: If you’ve been selling on Amazon for 10+ years, you may get paid for your sales the next day or shortly after. Amazon used to offer this to all sellers, but as the platform grew, issues with fraudulent products also increased. So in an effort to cut back on fraud, Amazon moved to longer payment terms for most sellers. If you were grandfathered in, consider yourself lucky.

Instant Access from Payability: For everyone else, the other way to get daily real-time payouts is with a financing solution like Payability’s Instant Access, which pays sellers one business day after shipping a sale. Instant Access levels the playing field for sellers that need faster access to their payouts in order to keep up with demand.

So how exactly does Payability Instant Access work? Every morning after Amazon’s sales day closes, Payability purchases the receivable that is owed to you by Amazon, and makes up to 80% of those funds available the next day, everyday (even weekends and holidays). With Instant Access, if you have $1,000 in your account on Monday, you’ll get $800 of it on Tuesday (the remaining $200 is kept on hold to cover any necessary returns or chargebacks and is then paid out according to your regular payout schedule).

You can spend your advanced funds on the Payability Seller Card immediately, or transfer to your bank the same business day with Same Day ACH transfer. You can also transfer funds to your bank account in seconds (24/7/365) for an additional fee.

With next-day access to your sales, you can improve your cash flow, turn inventory more quickly, stay ahead of the competition, and grow your business faster.

To qualify for Instant Access, you must have a minimum of 3 months of Amazon selling history and average monthly sales of $10,000 or more. . There are no credit checks or obligations associated with applying. You qualify instantly based on your Amazon sales.

Apply in minutes to get Next-Day Payouts starting as soon as tomorrow!

What Is an Amazon Account Level Reserve?

Many Amazon sellers deal with an account level reserve on their Payments report. But what exactly is it?

The account level reserve is the amount of money Amazon sets aside to cover any claims or chargebacks. It occurs when Amazon holds back all or part of your payment for more than 14 days.

Why does Amazon reserve any of your balance? It’s a way for them to combat fraud. In the past, scam sellers took advantage of Amazon before there was any holding period.

Scam sellers would sell a large amount of inventory for low prices and long delivery times. They could collect their sales money and then disappear before Amazon knew what was going on. Amazon then had to deal with angry customers and issue refunds themselves.

Today, Amazon issues normal payouts seven days after the expected delivery date, which gives the customer enough time to make a necessary return or complaint.

But, with an account level reserve, you have to wait twice as long or more. The payout of your account level reserve could roll over into your next payout or continue to be held for several payouts.

Why Did I Get a Reserve On My Account?

Checking your bank account or cash flow statement and finding that your Amazon earnings are tied up in reserves can be one of the most frustrating scenarios you encounter as an eCommerce seller. As such, it’s essential to understand why funds become temporarily unavailable so that you can prevent it from happening in the future. Here are some of the most common reasons Amazon puts reserves on seller accounts.

A-to-Z Guarantee Claims

Amazon’s A-to-Z guarantee claim allows buyers to return their purchases for full reimbursement if they are dissatisfied with the product or shopping experience. For instance, if you haven’t received your item within a certain period of time (usually the latest estimated delivery date), you can request a refund. Sellers with unresolved claims are subject to account reserves until those claims are taken care of.

Chargebacks

If you received a chargeback within the past three months, Amazon might reserve your funds until the chargeback has been fully processed. Be sure to check your balance sheet to determine whether you’ve had any chargebacks from your products or services in the last 90 days, as it’s crucial to deal with these as soon as possible to avoid a lengthy reserve period.

Account Reviews

Amazon puts accounts under review for suspicious activity. While it can be alarming to see your account has been suspended, there isn’t necessarily anything to worry about.

Sometimes, Amazon just likes to verify unusual transactions and ensure the accuracy of product listings. However, it’s not uncommon for sellers to discover that their funds are being held for reserve while their account is under review. This hold should disappear once the problem is resolved.

Low Performance

Amazon seller accounts are rated on a scale of 0 to 100 based on factors like shipping time, order cancellation rate, chargebacks, and customer reviews. The lower your seller rating, the higher the risk of reserves. In this case, an account reserve acts as insurance for any requested refunds or chargebacks that are likely to arise due to low levels of customer satisfaction.

You can avoid account level reserves by maintaining a high seller rating. Boosting your Amazon rating is as simple as ensuring quality products, timely deliveries, and customer support.

Tax Requirements

Your online store may be subject to specific tax guidelines. If so, Amazon is responsible for withholding funds to pay any sales-related taxes you’ve incurred over the year. If your taxes aren’t appropriately resolved with your flow from financing activities, Amazon may put a reserve on your account until you figure things out.

Amazon’s Reserve Tiers

As an Amazon seller, your reserve amount is based on several factors, including the age of your account and what disputes, if any, you’ve got pending. Amazon Pay calculates the reserve rate according to the following tiered model.

Tier I

New sellers are placed in Tier I and are subject to a reserve rate of 100%, meaning that all of their earned funds are held in reserve for a week after the transaction processing date. If everything checks out, funds are then disbursed to their bank accounts.

Tier II

Those that have used Amazon Pay for a year and completed at least 100 orders are upgraded to Tier II, which holds 3% of their daily processed payments over a 28-day average. Those transaction costs are also factored into the reserve rate if they have any pending disputes. Sellers can request to be moved to Tier II after just six months and 100 completed orders if they’ve maintained an Order Defect Rate under 1%.

Tier II Plus

Tier II sellers that have maintained an ODR rate of less than 1% for the past 60 days are automatically upgraded to Tier II Plus. Under this tier, Amazon only reserves the amount of unresolved chargebacks and A-to-Z guarantee claims. However, if your ODR rate exceeds 1% at any time, you will be downgraded to Tier II until you get your metrics up again.

How to Avoid An Account Level Reserve

To avoid an account level reserve in the future, run an audit of your account, including your overall seller performance, customer feedback, fulfillment updates, etc.

If any areas are concerning you, try to find the root of the problem so you can fix it before Amazon holds your payments even longer. But, keep in mind that you can do everything “right” and still end up with an account level reserve

If you sell in verticals such as shoes or clothing where returns and exchanges are more frequent due to sizing issues, account level reserves can be difficult to avoid even if your other metrics are outstanding.

And if you do have an account level reserve, keep reading for tips to help you through it.

What to Do When You Have An Account Level Reserve

Your account level reserve can be a huge setback for any seller trying to grow on Amazon. For one thing, you’re not getting paid at the time you expected. And, you likely won’t have a sense for how long Amazon will take to resolve your issue and disperse your funds.

Marketplace sellers that receive a significant portion of their revenue from Amazon sales may need that account level reserve to order inventory, make payroll, pay credit cards or invest in marketing.

While this all sounds overwhelming, you do have options. Here are six ways to overcome an account level reserve and the pros and cons of each:

1. Ask for an increased credit card limit

Pros: Fast way to get increased access to cash/spending power; you may need a larger limit in the future anyway

Cons: If you use your credit card irresponsibly, you might find yourself unable to pay down your balance; you might end up relying on that account level reserve to pay off your credit card bill (and it might not be released by your payment due date — or it won’t be enough to cover your full credit card balance)

2. Get a bank term loan

Pros: Low interest rates, long/favorable payment terms

Cons: Small businesses may not qualify (in fact, approval rates for small online businesses are very low); the application process is long and tedious, often taking longer than you have to wait for funds

3. Get an online business loan

Pros: Quick and easy application process; higher approval rates for small and online businesses

Cons: High interest rates and short payment terms

4. Tap into your savings

Pros: Immediate access to cash, without the need for an application or interest payments

Cons: Your savings may not be enough (or you may not have any to begin with); savings can take years to, well, save for and tapping into the funds should be your absolute last resort.

5. Ask suppliers for longer payment terms

Pros: You could get the inventory you need right away

Cons: This is not a long term solution and may end up being more expensive; you still might not have your payout when payment is due to your supplier; your supplier might not even agree to longer payment terms

6. Sign up for Payability’s Instant Access Daily Payout program

Pros: As mentioned above, Instant Access is a fast, easy, and long-term solution to seller cash flow issues. You’ll receive your own money faster,

Cons: Fees for early payouts and unlocking your account level reserve

Payability Instant Access can solve your account level reserve issue in 24 hours and acts somewhat like insurance against future unavailable balances or cash constraints that can hinder your growth. The application process is fast, simple and requires no credit checks, tax documents or waiting time. Approval is based on account health and sales performance. Once approved, you’ll receive up to 80% of whatever is currently in your Amazon payout the same day or the next day depending on the time of day your application is approved. You will continue to receive 80% of yesterday’s scanned and shipped sales each day. You can transfer all or some of your balance to your bank account with a same-day ACH transfer or spend it on the Seller Card and earn up to 2% cash back. The remaining 20% stays in a reserve to cover returns and chargebacks and is released to you when Amazon releases a payment (usually every 14 days).

Businesses that use Instant Access always know exactly when they are going to get paid and that’s the next day, every day. Instant Access is both a long term and short term solution to an account level reserve or gap in cash flow. Since you’re just getting your own money faster, Instant Access is a great way to fund your growth without taking on the risk of debt or the risk of another account level reserve when you were counting on a payout to cover your next round of inventory, credit card bill or operating expenses. As long as you continue to sell, Payability will continue to advance your funds the next day, every day.

Instant Access comes at a fee of 1-2% of sales depending on sales volume, your length of time as a Payability customer, and more. It’s worth noting too that in the event of an account level reserve, Payability will charge fees on the money advanced to manage the risk and cost of covering your reserves.

Take Control of Your Cash Flow & Unlock Your Account Level Reserve

When all is said and done, if payment delays and rollover balances are a problem for your business, Payability could be the right solution for you and applying is easy. Whether you want to unlock your account level reserve or just have cash-on-hand for the opportunities ahead, Instant Access might make sense for your business.

Simply submit an application, connect your marketplaces/eCommerce selling channels and Payability will evaluate your business based on your overall account health and sales performance — not your credit. In fact, your credit won’t be pulled at all. Once approved, you could see your funds that same day.

Disclaimer: Payability does not claim to have any insider information on the processes Amazon uses to decide when to release or not to release a payment. This is proprietary information unique to Amazon. The following is based on publicly available information and trends we have observed.

[/vc_column_text][/vc_column][/vc_row]