Cashflow is critical for all businesses, but it’s especially important for Amazon sellers. Sellers need cash-on-hand to take advantage of sudden growth opportunities. And this rings even truer during year-end and the holiday season, when most sellers see more sales by far than any other time of the year.

But, it takes Amazon weeks to pay sellers out, which can lead to cashflow troubles. If cashflow starts to dry up, you won’t have cash-on-hand to reinvest into your business and take advantage of growth opportunities.

Say you have a successful Black Friday / Cyber Monday. You won’t see any of your payout until weeks later. If you want to double down your investment on a hit product or winning ad to close the year as strong as possible, you’ll need cash from somewhere else. By the time Amazon pays you, it’ll be too late and the opportunity will have passed.

TL;DR: Cashflow is key when it comes to growing your Amazon business. Amazon’s payout window can negatively impact cashflow for sellers, especially during Q4. Faster payouts from Payability provide consistent cashflow and ensure you always have cash-on-hand from your Amazon sale.

Take advantage of big opportunities in Q4 with Payability.

The #1 Cashflow Problem for Amazon Sellers

Cashflow is king for Amazon sellers. Healthy cashflow means having cash-on-hand when you need it to take advantage of opportunities, like buying inventory at a bulk discount. Cashflow troubles, on the other hand, can quickly lead to problems, like stagnation and even insolvency. And if you’re selling on Amazon, you’re in this to make money and grow, not stagnate and flail.

You need cash-on-hand and healthy cashflow to keep your business growing. WIthout cash-on-hand, you can’t stock up on new products, replenish inventory, or launch new ad campaigns. You may even have a hard time keeping all the bills paid.

Amazon’s weeks-long payout process doesn’t help. It leaves a lot of sellers without the cash-on-hand that they need to keep growing their businesses. These businesses need to have a steady cashflow to cover their costs in the meantime.

The best way to avoid this fate as a seller is to carefully track your cashflow and make sure you always have enough cash on hand to cover your costs, even if/when Amazon is holding on to your money for weeks at a time.

You can also get faster access to your money from Amazon by using Payability. Payability can help you access money from your sales daily, as well as unlock your account level reserve.

This can be a challenge, but it is essential for Amazon sellers who want to not only stay in business but continue. When you don’t have enough cash-on-hand, it can lead to:

- Delayed inventory buys

- Longer stock outs

- Inability to make payroll & cover other core expenses

- Hinder future growth which could solve the problems above

Other Common Cashflow Problems For Amazon Sellers

Ever had an opportunity at hand but not had enough cash-on-hand to take advantage of it? It’s a common problem for Amazon sellers, especially with Amazon taking up to 28 days to payout sellers for sales.

Returns also pose a problem for some sellers. When a customer returns an item, the seller has to refund their money and also, sometimes, pay for the return shipping. This can eat into cash flow, especially if returns are high.

Another common issue is slow-moving inventory. If items aren’t selling quickly, cash flow can start to dry up because the money that was tied up in inventory isn’t coming in.

Finally, changes in Amazon’s policies can also disrupt cash flow. For example, if Amazon decides to increase fees or change its payment terms, that can put a strain on a seller’s cashflow. Or worse, an account suspension can shut off your cashflow and cripple your business

Because of all these factors, it’s important for Amazon sellers to closely monitor their cashflow and take steps to ensure that there’s always enough money coming in to meet their obligations. Payability can help by unlocking your account level reserve and providing daily access to your Amazon money. Payability helps you get access to your money even when you’re having trouble with Amazon’s payout process.

Profit Versus Cashflow For Amazon Sellers

Anyone who’s ever run a business knows that profit is important. After all, profit is what allows a business to grow, expand, and hire new employees. Profit is not the only thing that matters though – cashflow is crucial.

For Amazon sellers, this is especially true. Because Amazon collects payment from customers on behalf of the seller, there can be a delay of several weeks before the seller actually receives the money. (This creates a negative cash conversion cycle for Amazon. Read more about how Amazon’s CCC impacts your business and your CCC. )

For sellers, this can make it difficult to keep up with expenses, pay employees, and invest in new inventory. As a result, it’s important for Amazon sellers to carefully track both their sales revenue and their expenses, in order to ensure that they always have enough cash on hand to meet their obligations.

Only by carefully managing both profit and cashflow can an Amazon seller hope to be successful in the long term.

Avoiding A Cash Crunch As An Amazon seller

As an Amazon seller, it’s important to keep a very close eye on your cashflow. A cash crunch can happen when you suddenly have more expenses than you expected, or if your sales start to slow down. Or, there’s a delay in your payments. There are a few things you can do to avoid a cash crunch:

– First, always have at least three months of operating expenses saved up. This will give you a cushion to fall back on if your sales start to dip.

– Second, a business in a cash crunch can try to get paid upfront as much as possible. This is difficult with a business as big and powerful as Amazon. There are services, including ours, that offer expedited payments for Amazon sellers at reasonable prices so they can keep their business growing.

– Third, stay on top of your invoices and make sure you’re getting paid promptly for sales outside Amazon. You can do this by using accounting software, setting up reminders, or hiring an accountant to help you out.

Options for Improving Cashflow for Q4 as an Amazon Seller

One of the most important things to consider is how to finance any cash shortfalls that might occur. There are several options available, including savings, personal lines of credit, and outside funding.

Savings are always a good option to turn to, if possible. However, for many amazon sellers, this may not be enough to cover all cash shortfalls.

Personal lines of credit can be another helpful option. This can provide some much-needed breathing room to Amazon sellers who are expecting a temporary cash shortfall. But it can also come at a high cost and lead to long-term personal liability.

Some costs are worth it though when it comes to outside funding. It all depends on your business and your situation.

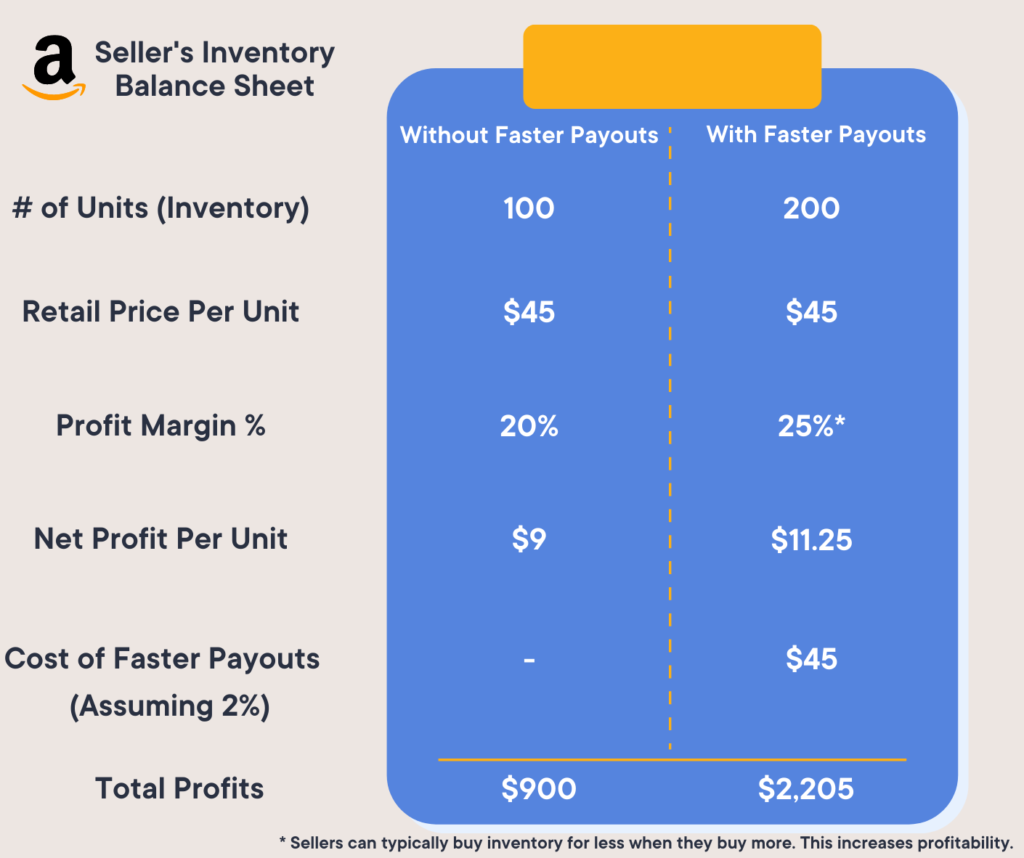

In the example below, it makes sense for Joe to pay for extra funding – specifically faster payments for his Amazon sales.

With extra funding, he’s able to buy more inventory and get a discount, bumping up his profit margin and his overall profits.

And it’s thanks to outside funding that comes at a cost, but also a big benefit—substantially more profit.

Get Paid Faster, Improve Your Cashflow, Grow More in Q4

One option that’s nearly guaranteed to increase cash flow is getting early access to your payments from Amazon. However the payments are expedited—daily, weekly, etc— getting paid early means you can reinvest that money back in your business and ultimately grow your profits.

Payability has been providing faster payouts to Amazon sellers since 2015, with over $5 billion in payments provided to sellers like you. With Payability, you always have cash-on-hand because you get up to 80% of your Amazon sales revenue on a daily basis—You get paid out every single day. This will help you re-up on inventory, spending on digital ads, and do whatever else it takes to grow your business faster.

You don’t have to wait around for Amazon anymore. Get paid out daily and kick your Amazon business into a higher gear. Grow your business (and your profits) faster than you would otherwise with Payability.

Get started with Payability in minutes. All Amazon sellers with over $10k monthly sales qualify.